Managing employee payments accurately and on time represents one of the most critical responsibilities for any UK business. The right payroll solution can transform what was once a time-consuming administrative burden into a streamlined, automated process that ensures compliance with HMRC regulations while reducing costly errors.

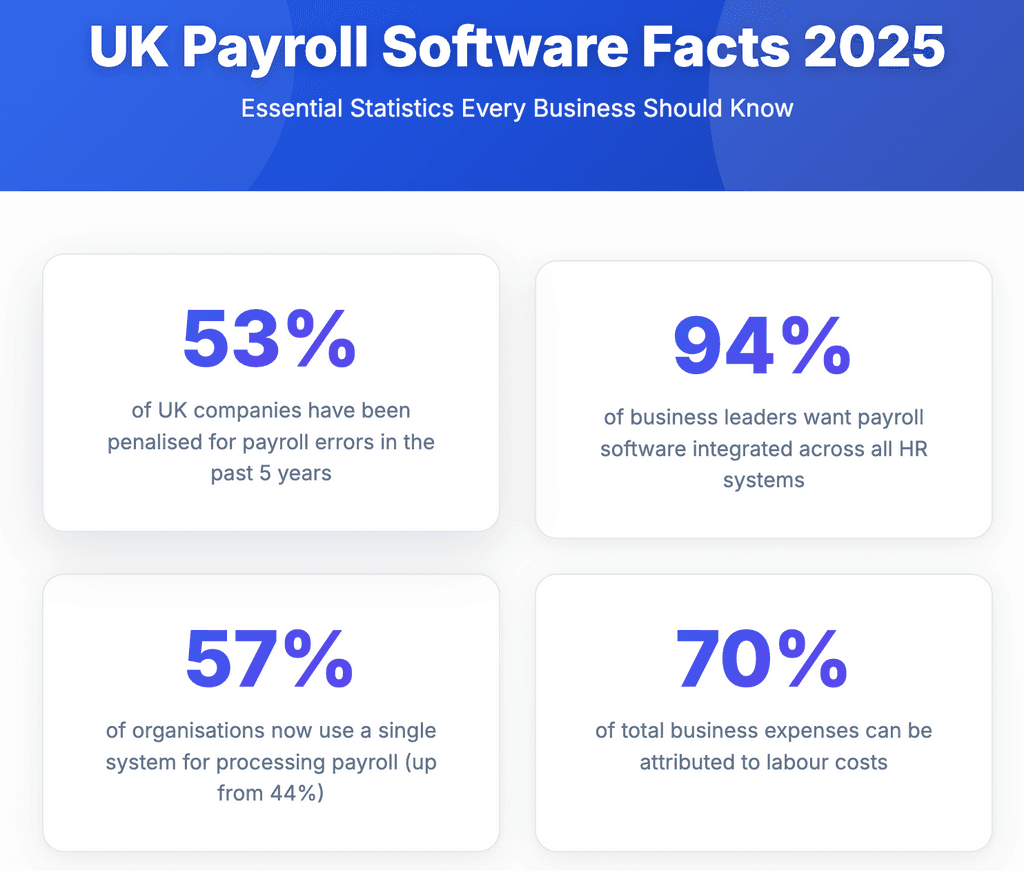

Finding the best UK payroll software requires careful consideration of your specific business needs, from the number of employees you manage to the complexity of your pay structures. With over 53 percent of UK companies facing penalties for payroll errors in recent years, selecting a robust and reliable system has never been more important.

This comprehensive guide examines the leading payroll platforms available to UK businesses today, providing detailed insights into features, pricing structures, and practical recommendations to help you make an informed decision.

What Makes Great Payroll Software

Before diving into specific solutions, understanding the essential features that define excellent payroll software helps clarify what to prioritise during your evaluation. The best UK payroll software combines several key capabilities that work together to simplify your operations.

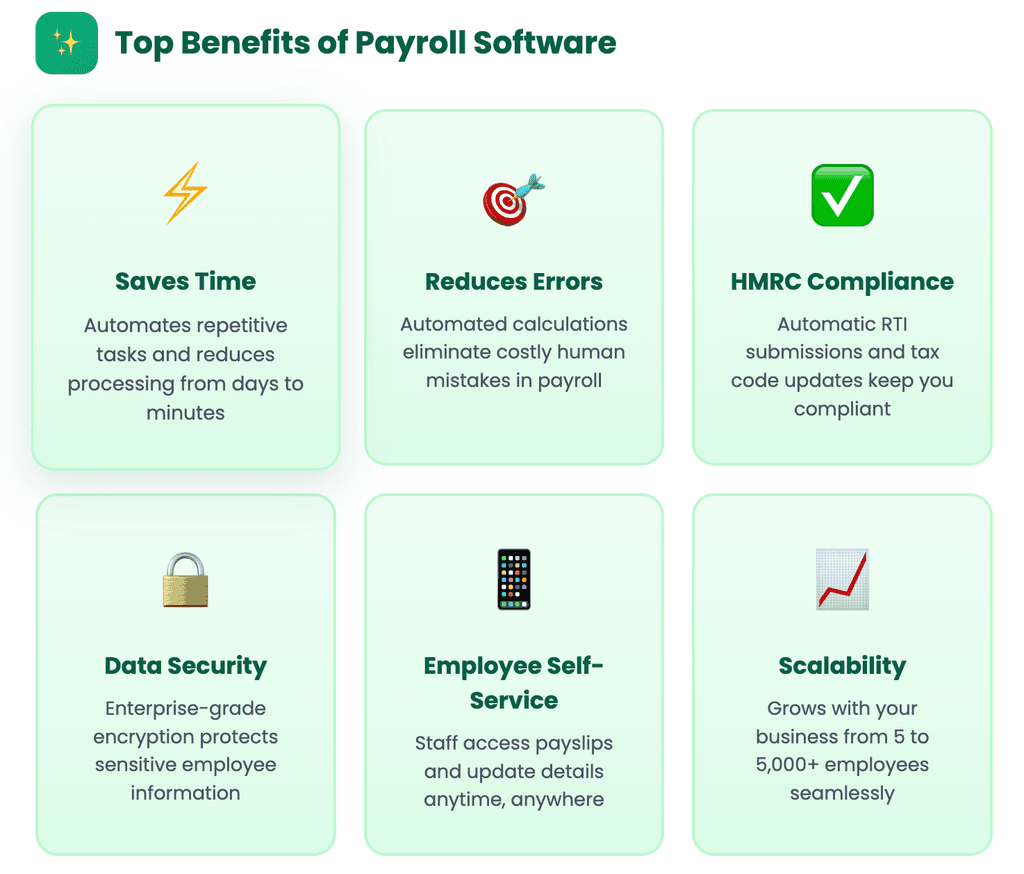

HMRC Recognition and Compliance stands as the foundation of any credible payroll solution. Software must support Real Time Information (RTI) submissions, handle PAYE calculations automatically, and stay current with changing tax legislation. Without HMRC recognition, you risk submitting incorrect information and facing potential fines.

Pension Auto-Enrolment has become mandatory for UK employers, making automated pension management essential. Quality platforms assess employee eligibility, calculate contributions accurately, and submit payments to pension providers seamlessly.

Employee Self-Service reduces administrative workload significantly. When staff can access their own payslips, update personal details, and submit leave requests through a dedicated portal, your HR team gains valuable time for more strategic activities.

Integration Capabilities determine how smoothly your payroll data flows into accounting systems, HR platforms, and banking services. The best UK payroll software connects natively with popular solutions like Xero, Sage Accounting, and QuickBooks, ensuring your financial data remains synchronised across all systems.

Top UK Payroll Software Solutions

Sage Payroll

Sage has established itself as a household name in UK business software since 1981, and their payroll offerings continue to serve organisations of all sizes effectively. Sage Business Cloud Payroll provides a cloud-based solution ideal for smaller operations, while Sage 50 Payroll caters to larger enterprises with more complex requirements.

Pricing begins at £10 per month for the Essentials plan, which includes five employees and covers basic payroll processing, RTI submissions, and year-end reporting. The Standard plan at £20 monthly adds time tracking and enhanced reporting, while Premium at £60 provides comprehensive HR analytics and expense management.

Sage excels particularly in its 24/7 customer support and extensive integration with the broader Sage ecosystem. Businesses already using Sage Accounting find the seamless data synchronisation particularly valuable for maintaining accurate financial records.

Xero Payroll

Xero approaches payroll as an integrated component of its accounting platform rather than a standalone product. This philosophy creates exceptional value for businesses already invested in the Xero ecosystem, as payroll data flows directly into financial reports without manual intervention.

The Grow plan at £42 per month includes payroll for one user, while Comprehensive at £47 extends this to five users. Ultimate pricing reaches £55 monthly but covers up to ten employees within the subscription. Additional employees cost £1.50 each per month on most plans.

Xero's strengths lie in its intuitive interface and the popular Xero Me mobile app, which empowers employees to view payslips and manage their information independently. The platform handles statutory pay calculations automatically and maintains strong connections to major UK pension providers including Nest.

BrightPay

BrightPay has earned a devoted following among accountants and payroll bureaus for its straightforward pricing and comprehensive feature set. The platform offers both desktop and cloud versions, though the desktop version is scheduled for discontinuation after the 2026/27 tax year.

Desktop licensing follows a per-tax-year model with pricing from £79 for up to three employees, £139 for ten employees, £209 for twenty-five, and £289 for unlimited. The cloud version charges based on actual usage, making costs predictable and scalable.

What distinguishes BrightPay is its batch processing capability for payroll bureaus and direct integration with the Modulr payment platform. The software maintains a remarkable 99% customer satisfaction rate for support services, reflecting genuine commitment to user success.

HiBob

HiBob has emerged as a leading people-first HR and payroll platform trusted by over 4,400 companies worldwide. The platform combines comprehensive HR functionality with native UK payroll processing, creating a unified experience where employee data and payroll operations live on the same system. Many analysts now consider HiBob among the best UK payroll software options for organisations prioritising employee engagement.

Following the acquisition of Pento, HiBob now offers end-to-end payroll processing specifically built for the UK market. The deep integration eliminates duplicate data entry and reduces errors caused by manual uploads between separate systems. Pricing typically ranges from £13 to £20 per employee per month, with implementation fees around 10-20% of annual software costs.

What sets HiBob apart is its emphasis on employee engagement alongside payroll functionality. The platform automatically syncs and updates employee tax codes and student loans, alerts administrators to National Minimum Wage compliance issues, and handles all end-of-tax-year duties. With over 1,900 five-star G2 reviews and recognition as one of the UK's Best Workplaces in Tech 2026, HiBob delivers both operational excellence and exceptional user experience.

Employment Hero

Employment Hero positions itself as an all-in-one HR and payroll platform specifically designed for UK SMEs. The integrated approach means employee data entered once flows throughout the entire system, eliminating duplicate entry and reducing error potential.

The platform handles PAYE submissions automatically and streamlines auto-enrolment processes with minimal manual intervention. Digital payslips delivered through the self-service portal reduce paper waste while giving employees immediate access to their payment information.

Pricing operates on a per-employee basis, making it suitable for growing businesses that need flexibility. The platform's award-winning design has earned global recognition for providing outstanding product and customer experience.

QuickBooks Payroll

QuickBooks Payroll serves UK businesses already using QuickBooks Online for accounting, creating a unified financial management experience. The tight integration means payroll expenses automatically appear in profit and loss reports, simplifying month-end reconciliation.

The platform automates weekly or monthly pay runs, calculates taxes correctly, and submits RTI information to HMRC without manual intervention. Statutory pay for sick leave, maternity, paternity, and bereavement situations is handled automatically based on current legislation.

Subscription pricing combines a base monthly fee with per-employee charges, though promotional discounts frequently reduce initial costs significantly. The familiar QuickBooks interface ensures minimal learning curve for existing users.

Feature Comparison

When evaluating the best UK payroll software, comparing core capabilities side by side helps identify which solution aligns with your priorities. All platforms discussed here carry HMRC recognition, ensuring compliance with RTI and PAYE requirements.

Pricing Structure varies considerably across providers. Sage and Xero operate on monthly subscription models, while BrightPay's desktop version charges annually. Per-employee pricing becomes important as your workforce grows, with costs ranging from £1 to £5 per person monthly depending on the platform and plan level.

Auto-Enrolment Support appears universally, though implementation quality differs. BrightPay's smart alerts proactively notify administrators of required actions, while Xero's direct connections to Nest and People's Pension simplify contribution submissions.

Reporting Capabilities range from basic payroll summaries to comprehensive analytics dashboards. Staffology and Sage Premium offer the most advanced reporting, including custom report builders and detailed audit trails essential for larger organisations.

Mobile Access has become standard expectation, with Xero Me, Sage, and Employment Hero each providing employee-facing apps. These applications typically allow payslip viewing, leave requests, and personal detail updates from any device.

How to Choose the Right Solution

Selecting the best UK payroll software for your organisation requires honest assessment of current needs and realistic projections for future growth. Several factors should guide your decision-making process.

Current Employee Count and Growth Plans directly impact pricing calculations. If you expect significant workforce expansion, platforms with favourable per-employee scaling like BrightPay's unlimited desktop licence or Sage's tiered discounts may prove more economical over time.

Existing Software Ecosystem influences integration requirements substantially. Businesses deeply invested in Xero accounting should strongly consider Xero Payroll for seamless data flow. Similarly, Sage users benefit from staying within that ecosystem.

Complexity of Pay Structures determines necessary feature depth. Organisations with hourly workers, shift differentials, or contractor payments need platforms capable of handling multiple pay frequencies and calculation methods simultaneously.

Support Requirements matter particularly for businesses without dedicated payroll expertise. Sage's 24/7 availability and BrightPay's consistently praised customer service teams provide reassurance when challenges arise unexpectedly.

Budget Constraints obviously influence selection, though the cheapest option rarely delivers the best value. Consider total cost of ownership including potential integration fees, training time, and the hidden cost of errors from less capable systems.

Conclusion

The UK payroll software market offers excellent solutions for organisations of every size and complexity level. Sage remains the established leader with comprehensive capabilities and unmatched support availability. Xero provides exceptional value for businesses already using its accounting platform, while BrightPay delivers remarkable cost efficiency particularly for payroll bureaus and accountancy practices.

For growing SMEs seeking an integrated HR and payroll approach, Employment Hero and Staffology present compelling alternatives that reduce administrative fragmentation. QuickBooks Payroll serves its accounting software users admirably, though businesses without existing QuickBooks investment may find better value elsewhere when searching for the best UK payroll software.

Whichever platform you select, ensure it carries HMRC recognition, supports pension auto-enrolment, and offers the integrations your business requires. Taking advantage of free trials before committing allows hands-on evaluation that no amount of research can replicate.

Frequently Asked Questions

What is the most popular payroll software in the UK? Sage consistently ranks as the most widely used payroll solution among UK businesses, followed closely by Xero and BrightPay. When evaluating the best UK payroll software, popularity varies by business size, with Sage dominating among established SMEs while Xero appeals particularly to newer businesses already using its accounting platform.

How much should I expect to pay for payroll software? Basic payroll solutions start around £10-20 monthly for small teams, scaling upward based on employee count and feature requirements. Budget approximately £3-5 per employee per month for mid-range functionality, with enterprise solutions commanding higher investment.

Can I switch payroll providers mid-year? Yes, though timing matters for smooth transition. Many businesses prefer switching at tax year end (April) to simplify year-end reporting. Mid-year switches require careful data migration and verification to ensure continuity of employee records and tax calculations.

Do all UK payroll systems support Making Tax Digital? HMRC-recognised payroll software automatically supports MTD requirements for PAYE submissions. All platforms reviewed in this article maintain current HMRC recognition and handle RTI submissions appropriately.

What happens if I make a payroll error? Quality payroll software includes correction workflows that adjust subsequent payslips appropriately. HMRC accepts amended submissions, though persistent errors may trigger investigations. Reliable software significantly reduces error likelihood through automated calculations and validation checks.