Accurate calculation of employee hours isn't just a payroll requirement—it's a foundation of workplace trust, compliance, and financial management. Whether you manage hourly workers, salaried employees eligible for overtime, or a mixed workforce, this comprehensive guide will walk you through proven methods to calculate employee hours worked with precision and confidence.

Why Accurate Hour Calculation Matters

Calculating employee hours worked correctly impacts multiple aspects of your business:

- Legal compliance: The Fair Labor Standards Act (FLSA) and state labor laws mandate proper timekeeping and overtime pay

- Payroll accuracy: Ensures employees receive fair compensation for their actual work time

- Budget management: Helps control labor costs and project future staffing needs

- Employee satisfaction: Builds trust when workers see their time valued and compensated accurately

- Audit protection: Provides documentation to defend against wage claims or Department of Labor investigations

Different Types of Work Hours

Before calculating hours, you need to understand the different categories of work time:

Regular Hours

Standard work hours performed during normal business operations, typically 40 hours per week for full-time employees.

Overtime Hours

Hours worked beyond 40 in a workweek (under federal law) that require premium pay at 1.5 times the regular rate. Some states have daily overtime thresholds.

Double-Time Hours

In some states like California, hours worked beyond 12 in a single day may require double-time pay.

Break Time

Short rest periods (usually 5-20 minutes) count as paid work time, while longer meal periods (typically 30+ minutes) can be unpaid if employees are completely relieved of duties.

Travel Time

Some work-related travel counts as compensable time, including travel between work sites during the workday.

Training and Meeting Time

Mandatory meetings, training sessions, and workshops generally count as paid work time.

On-Call Time

May be compensable depending on restrictions placed on the employee's freedom.

Step-by-Step Calculation Methods

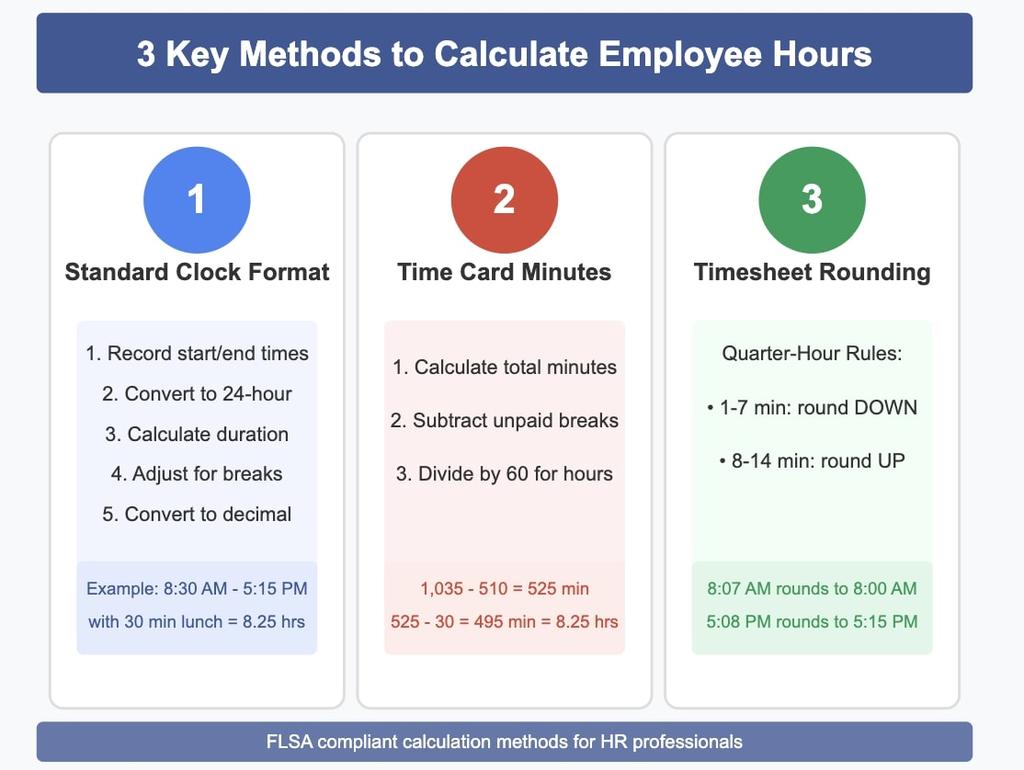

Method 1: Calculating Hours from Clock Times (Standard Format)

The most common method for calculating employee hours worked involves converting clock times to decimal hours:

- Record start and end times for each work period

- Convert times to 24-hour format for easier calculation

- Calculate the duration by subtracting start time from end time

- Adjust for unpaid breaks by subtracting break duration

- Convert minutes to decimal hours by dividing minutes by 60

Example:

- Clock-in: 8:30 AM

- Lunch break: 12:00 PM - 12:30 PM (30 minutes, unpaid)

- Clock-out: 5:15 PM

Calculation:

- Convert to 24-hour: 8:30 to 17:15

- Total duration: 17:15 - 8:30 = 8 hours and 45 minutes

- Subtract unpaid lunch: 8:45 - 0:30 = 8 hours and 15 minutes

- Convert to decimal: 8 + (15 ÷ 60) = 8 + 0.25 = 8.25 hours

Method 2: Using Time Card Minutes

Some companies track time in minutes rather than hours:

- Calculate total minutes worked from clock times

- Subtract unpaid break minutes

- Divide by 60 to convert to decimal hours

Example:

- Clock-in: 8:30 AM (510 minutes from midnight)

- Clock-out: 5:15 PM (1,035 minutes from midnight)

- Unpaid lunch: 30 minutes

Calculation:

- Total minutes: 1,035 - 510 = 525 minutes

- Minus lunch: 525 - 30 = 495 minutes

- Convert to hours: 495 ÷ 60 = 8.25 hours

Method 3: Timesheet Rounding

The Department of Labor allows rounding to the nearest quarter hour (15 minutes) if applied fairly:

- 1-7 minutes round down to the previous quarter hour

- 8-14 minutes round up to the next quarter hour

Example:

- Clock-in: 8:07 AM (rounds to 8:00 AM)

- Clock-out: 5:08 PM (rounds to 5:15 PM)

- Result: 9.25 hours before lunch deduction

Important note: Rounding must not consistently favor the employer. If you use rounding, ensure your systems apply it neutrally.

🚀 Try our free Employee Hours Calculator for instant, accurate results!"

Special Scenarios in Hour Calculation

Calculating Overtime Hours

To calculate overtime correctly:

- Determine the FLSA workweek (fixed 168-hour period)

- Total all hours worked during that workweek

- Subtract 40 hours to find overtime hours

- Multiply overtime hours by 1.5 and by the regular rate of pay

Example:

- Monday: 9 hours

- Tuesday: 8.5 hours

- Wednesday: 9.5 hours

- Thursday: 8 hours

- Friday: 7 hours

- Total: 42 hours

- Overtime: 2 hours (42 - 40)

Calculating Hours for Salaried, Non-Exempt Employees

Salaried employees who don't meet exemption criteria still earn overtime:

- Calculate the regular hourly rate by dividing weekly salary by 40

- Track actual hours worked beyond 40

- Apply overtime premium (0.5x regular rate) for hours over 40

Example:

- Weekly salary: $900

- Regular rate: $900 ÷ 40 = $22.50/hour

- Actual hours worked: 45

- Regular pay: $900 (salary covers all regular time)

- Overtime premium: 5 hours × ($22.50 × 0.5) = $56.25

- Total weekly pay: $900 + $56.25 = $956.25

🚀 Try our free Employee Hours Calculator for instant, accurate results!"

Calculating Partial Day Absences for Exempt Employees

While exempt employees generally receive full salary regardless of hours worked, calculate partial day absences for PTO deduction:

- Establish standard daily hours (typically 8)

- Record actual time worked

- Calculate difference for PTO deduction

Caution: Improper deductions from exempt employee salaries can jeopardize their exempt status.

Tools and Systems for Tracking Hours

The right time tracking system greatly simplifies hour calculations:

Time Clock Systems

Physical or digital time clocks offer:

- Accurate punch records

- Automatic calculation of hours

- Rounding according to company policy

- Exception flagging for review

Mobile Apps

Modern time tracking apps provide:

- GPS verification of location

- Project/task tracking

- Real-time visibility for managers

- Digital approval workflows

Biometric Systems

Advanced time systems use fingerprints or facial recognition to:

- Prevent buddy punching

- Ensure secure verification

- Create legally defensible records

When selecting a time tracking system, consider integration with your payroll platform, ease of use, compliance features, and reporting capabilities.

Common Compliance Challenges

Even experienced HR professionals face these common pitfalls when calculating employee hours worked:

Off-the-Clock Work

Employees checking email after hours, preparing for shifts before clocking in, or cleaning up after clocking out creates compensable time that often goes unrecorded.

Solution: Create clear policies about work outside scheduled hours and train managers to recognize and authorize all work time.

Break Violations

Automatic break deductions that don't reflect actual breaks taken can lead to underpayment.

Solution: Require employees to record actual break times or implement exception reporting for missed breaks.

Misclassification Issues

Treating non-exempt employees as exempt to avoid calculating overtime hours creates significant liability.

Solution: Conduct regular classification audits using the Department of Labor's duties tests.

Record Retention Problems

Insufficient time records make defending wage claims difficult.

Solution: Maintain detailed time records for at least 3 years (federal requirement) or longer if required by state law.

Best Practices for HR and Payroll Teams

Follow these recommendations to ensure accurate calculation of employee hours worked:

- Establish clear written policies on timekeeping, overtime approval, and break requirements

- Train employees and managers on proper time recording procedures

- Conduct regular timecard audits to catch patterns of missed punches or unauthorized overtime

- Create exception reports to flag unusual time entries for review

- Document your calculation methods to demonstrate good-faith compliance efforts

- Cross-train payroll staff on hour calculation procedures

- Stay current on changing regulations that affect timekeeping requirements

"Transparency in how you calculate hours builds employee trust," explains James Wilson, CHRO at Meridian Manufacturing. "When we implemented our new calculation policy with clear examples, wage disputes dropped by 64%."

Useful Resources

To simplify your hour calculations, download these helpful tools:

Frequently Asked Questions

How do you calculate hours worked in a day?

Subtract the start time from the end time and adjust for any unpaid breaks. Convert the result to decimal hours by dividing minutes by 60.

Do I need to calculate hours for salaried employees?

For exempt salaried employees, hour tracking is optional but recommended for PTO management. For non-exempt salaried employees, you must track hours and calculate overtime.

How do I handle employees who work multiple positions with different pay rates?

Calculate regular and overtime hours separately for each position, then apply the weighted average method or higher rate method according to your company policy.

Can employees waive their right to overtime pay?

No. Even with a signed agreement, employees cannot waive their statutory right to overtime compensation.

How precisely must we track employee hours?

The FLSA doesn't specify a required timekeeping method, but your system must be complete and accurate. Courts generally expect precision to the minute when technology permits it.

Calculating employee hours worked accurately protects both your business and your employees. By implementing systematic processes, appropriate technology, and regular audits, you can ensure compliance while creating a foundation of trust in your workplace.

Ready to improve your timekeeping processes? Consider scheduling a payroll compliance review to identify areas for improvement in how you calculate and document employee hours.

About the Author: Sarah Johnson is a certified Senior Professional in Human Resources with over 15 years of experience in payroll management and wage-hour compliance. She serves as a consultant to mid-size businesses implementing time tracking solutions.